How to File A Property Damage Insurance Claim After a Tornado or Severe Weather

Maximizing Your Tornado Damage Claim: Essential Steps for Slidell Homeowners and Commercial Property Investors

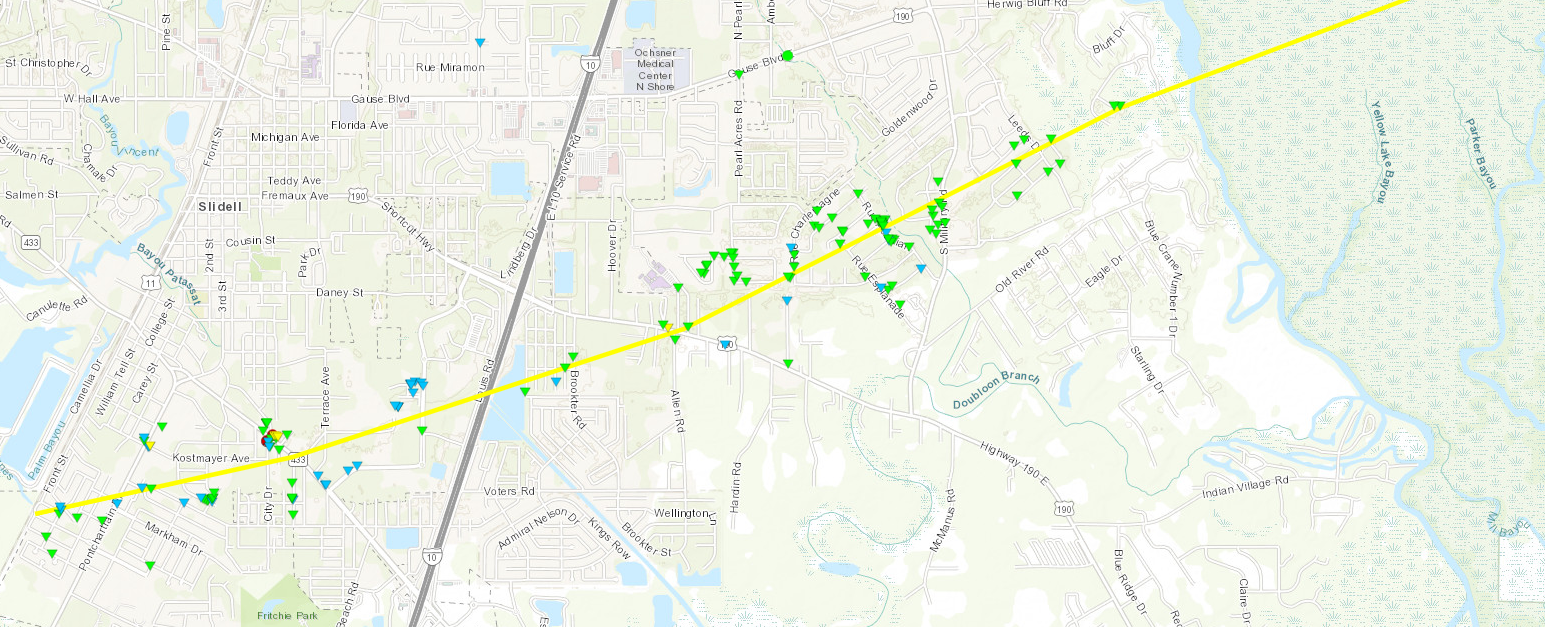

Louisianians are used to extreme weather. When it comes to weather-related emergencies, we have seen people come together time and time again to help their neighbors and keep their families and friends safe. The same was true during last week’s tornadoes across the State. It's a relief that the impact, though significant, didn't result in more tragic outcomes. We recognize the importance of community preparedness and response efforts in safeguarding lives during these types of weather events. But, after the storm has passed and everyone is safe, how should you handle property damage? Read on for advice about how to file your property damage insurance claim in Louisiana.

What to do if your property is damaged in a tornado or other severe weather?

Locate your insurance information. Initiate contact with your insurance provider or agent to start the claims process. Ensure you have your policy number on hand and provide an initial assessment of the damage. Make sure that your agent and insurance company have good contact information for you, including phone number and email address that you actually check.

1. Document the damage.

Capture visual evidence of the damage through photographs or video footage before engaging in any cleanup efforts. Try to preserve the scene as it is to facilitate an accurate assessment by the claims adjuster. As you start to clean up your personal belongings, try not to get rid of items. Instead, separate the damaged belongings from those unaffected. Even your damaged items can contribute to the inventory of losses.

2. Make necessary temporary repairs.

Even though you have insurance and suffered property damage from the weather, you still have the responsibility to safeguard your property from further harm. Think about things like covering damaged roofs with tarps or securing broken windows with wood. Retain receipts for any expenses incurred to make these quick fixes because you may be able to get reimbursed later.

3. Report your claim to your insurer in writing.

While many property owners initially report their tornado damage and other property damage over the phone to their agent or insurance company, it’s important to ensure your claim is reported in writing, quickly to the insurance company. Keep in mind, it’s your insurance company that must make sure has notice of your claim, not just your agent. It’s also important to keep a good record of all your talks with your insurance company. Even though you’ll probably talk to your insurance adjuster on the phone, try to follow up those conversations with something in writing, like an email that summarizes what was said and what they promised. This doesn’t mean you shouldn’t talk to them at all—just make sure you also have a written record. Writing things down after you talk helps keep everyone on the same page and gives you something solid to refer back to. This way, you have clear proof of what was said and agreed on, which can really help move things along smoothly.

4. Work with your adjuster.

When an insurance adjuster visits your property, ask for identification before allowing them access. How can you tell if an adjuster is licensed? You can use the look up feature on the the Louisiana Department of Insurance to verify insurance adjusters, adjusters, agencies and appraisers in Louisiana: https://www.ldi.la.gov/onlineservices/ProducerAdjusterSearch/

5. Hire an experienced property damage attorney to protect your interests.

Hiring an experienced Louisiana property damage attorney like Christopher Stow-Serge can help you to navigate the insurance claims process and protect your interests at every step. An attorney can help you properly file and document your claim and negotiate and communicate with the insurance company on your behalf. For complex claims involving extensive damage, multiple parties, or issues with liability, the Stow Firm can provide valuable guidance and ensure that your rights are protected throughout the claims process. Hiring the Stow Firm is particularly critical in cases where the property damage results in significant financial losses, such as damage to a business or commercial property or high-value assets. Some insurance policies, especially commercial or specialized policies, contain complex provisions or exclusions that require legal interpretation. The Stow Firm has the experience to help you understand your rights under your policy.