Blog

Blog

By Chris Stow

•

March 3, 2025

In New Orleans’ 2024 reassessment cycle, residential property taxes rose nearly 18%, but hotels and other commercial properties faced even steeper hikes, with some tax bills doubling . [1] This disproportionate increase highlights a growing burden on the hospitality sector. Understanding how these assessments are determined is crucial for hotel investors, as they signal a broader shift in commercial property valuation. By analyzing the factors driving these spikes, investors can better navigate the evolving tax landscape and protect their bottom line. New Orleans: A Case Study in Rising Commercial Hospitality Property Taxes In tax year 2024, Orleans Parish assessed a total of $51.5 billion across 153,628 taxable parcels, averaging a fair market value of $335,315 per parcel. Of this, commercial property made up 21.2%, or approximately $10.9 billion in taxable value. [2] A recent study by Trepp identified New Orleans as the metropolitan area with the highest year-over-year increase in commercial real estate taxes, surging by 14.7% from 2022 to 2023. [3] The city’s latest quadrennial reassessment in 2024 has emphasized this trending increase of taxable assessments for commercial hospitality properties, affecting both small boutique hotels and large chain properties. For example, the Royal Sonesta experienced a 98.27% increase from 2023 to 2024 in value assessed taxes, with its assessed value increasing from $5.2 million in 2023 to $10.4 million in 2024. [4] Similarly, the NOPSI hotel experienced a 89.39% increase from 2023 to 2024 in value assessed taxes, with its assessed value increasing from $1.9 million in 2023 to $3.6 million in 2024. [5] Both hotel properties have not had any major renovations, the last being in 2016 for the Royal Sonesta and 2017 for the NOPSI hotel. Further, both properties have not recently sold. [6] These taxable assessment increases are not isolated to just a few downtown hotels. They reflect a broader trend of increasing assessment values of commercial hospitality properties across New Orleans: “Know Your Worth”— A Cautionary Heeding to the New Orleans Hospitality Market While commercial property taxes have increased substantially for many hospitality properties in downtown New Orleans, some New Orleans Hotels are not standing idly by. For instance, the Omni Royal Orleans, with a 110.54% increase in the taxable assessment of its property, appealed their property taxes in 2024. [7] This resulted in a change order for the property with a 10.34% decrease to the taxable value of the building, equating to a reduction in their assessed valuation of $804,340. [8] This amounts to a tax savings of $106,164.83. [9] Similarly, the Royal Sonesta appealed its tax assessment in 2024. [10] This resulted in a change order for the property with a 16.41% decrease to the taxable value of the building, equating to a reduction in their assessed valuation of $1,720,800. [11] This amounts to a tax savings of $227,128.39. [12] Why Are Commercial Hospitality Property Taxes Rising in New Orleans? Hotel owners across New Orleans have seen a sharp rise in property tax assessments, but what’s driving these increases? Here are three key factors impacting hotel property valuations: Inflation While the U.S. hotel industry saw profit growth in 2024, rising labor costs and inflation have significantly limited those gains. [13] Raquel Ortiz, senior manager of financial performance at STR, noted that “demand growth has been key to driving total revenues, which have been the best defense against high expenses and allowed for hotels to increase profits, albeit minimal.” [14] Ultimately, despite its effect on a hotel’s net operating income (NOI), inflation is not a factor considered by the Orleans Assessor’s Office when evaluating property values. This results in assessed property values that fail to reflect the financial strain inflation imposes on hotel operations. Rising Insurance Costs Commercial properties in New Orleans saw an average 37% increase in insurance expenses from 2022 to 2023, the highest year-over-year rise among any U.S. city. [15] A key driver of these soaring insurance costs is the city's vulnerability to natural disasters. According to First Street’s latest report, New Orleans ranks among the top five metro areas facing the steepest insurance premium hikes, with residential premiums projected to rise by nearly 196% and flood damage costs expected to surge by 533%. [16] Yet, like inflation, the Assessor’s Office does not account for these rising insurance costs when assessing commercial property values. [17] Renovations and Modernization The Orleans Parish Assessor, Erroll Williams, has emphasized that renovations play a key role in determining property values, stating: “The ones that have been renovated are worth more than the ones that have not. That’s a fact.” [18] However, the actual tax assessment data suggests inconsistencies. For example, Hotel Monteleone underwent multi-million dollar renovations in 2023, yet its assessed value increased by only 6.82%. [19] Meanwhile, Hilton Riverside saw one of the highest taxable value increases at approximately 120%, despite its last major renovation occurring in 2017. [20] These discrepancies suggest that the Assessor’s Office isn’t applying its valuation criteria consistently, with some hotels seeing sharp tax hikes despite having no recent renovations. Looking Ahead: How Hotel Investors in New Orleans Can Lower Their Tax Bill As the city hosts major events like Mardi Gras, Jazz Fest, Essence Festival, and so forth, the improving tourism economy will likely boost commercial property values and make locations more attractive; in turn, it will also have the effect of driving up property tax assessments. [21] The next major reassessment cycle, in 2028, for New Orleans is likely to bring even more volatility to commercial property tax assessments. However, commercial property owners do not have to wait till 2028 to get a fair adjustment to their property’s assessed value. In Orleans Parish, the open rolls period to appeal property taxes is scheduled to run from mid-July to mid-August. With a proactive response through the property tax appeal process , commercial property investors can ensure their properties are not being overvalued and, ultimately, save tens of thousands of dollars in taxes. ---------------------------------------------------------------------------------------------------------------- [1] Paul Murphy, Orleans property tax bills will be out soon - and they'll be higher, WWLTV, (Jan. 19, 2024, 1:25 PM), https://www.wwltv.com/article/news/local/orleans/new-orleans-property-tax-assessments-to-rise-as-school-board-votes-to-roll-millage-foward/289-98e0e183-410d-4ef7-8f7c-44a56f86fe68 [2] Steve Wilson, Audit: Orleans Parish used prohibited 'sales chasing' to grow assessed values, The Center Square, (Dec. 30, 2023), https://www.thecentersquare.com/louisiana/article_29aad166-a5cc-11ee-97ed-8324ed068b6d.html [3] Breaking Down Office Property Operating Expenses Across the U.S., Trepp, (Sept. 2024), https://www.trepp.com/hubfs/Trepp%20Breaking%20Down%20Office%20Property%20Expenses%20Full%20Report%20Sept%202024.pdf?hsCtaTracking=f729838e-ffa9-494a-b77d-28c7632b2f98%7Cad99e19c-e027-4639-9346-496522b6f86a. [4] Orleans Parish Assessor’s Office, 300 BOURBON ST, (last visited Feb. 15, 2025), https://beacon.schneidercorp.com/Application.aspx?AppID=979&LayerID=19792&PageTypeID=4&PageID=8663&Q=1886938444&KeyValue=300-BOURBONST [5] Orleans Parish Assessor’s Office, 317 BARONNE ST, (last visited Feb. 15, 2025), https://beacon.schneidercorp.com/Application.aspx?AppID=979&LayerID=19792&PageTypeID=4&PageID=8663&Q=1886938444&KeyValue=317-BARONNEST [6] Id. [7] Orleans Parish Assessor’s Office, 621 ST LOUIS ST, (last visited Feb. 15, 2025), https://beacon.schneidercorp.com/Application.aspx?AppID=979&LayerID=19792&PageTypeID=4&PageID=8663&Q=1886938444&KeyValue=621-STLOUISST [8] Id. [9] Id. [10] Orleans Parish Assessor’s Office, supra note 4. [11] Id. [12] Id. [13] U.S. hotel profits grew in 2024 but were limited by inflation and labor costs, STR, (Feb. 14, 2025), https://str.com/press-release/us-hotel-profits-grew-2024-were-limited-inflation-and-labor-costs#:~:text=2024%20per%2Davailable%2Droom%20metrics%20(%25%20change%20from%202023)&text=%E2%80%9CGrowth%20in%20total%20operating%20expenses,growth%20that%20has%20impacted%20margins.%E2%80%9D [14] Id. [15] Trepp, supra note 3. [16] Id. [17] Orleans Parish Assessor’s Office, FAQ, (last visited Feb. 26, 2025), https://www.nolaassessor.com/faq/ [18] Lily Cummings, Audit shows thousands of New Orleans homeowners may be overpaying on taxes, WWLTV, (Dec. 28, 2023, 7:51 PM), https://www.wwltv.com/article/news/local/audit-shows-thousands-of-new-orleans-homeowners-may-be-overpaying-on-taxes/289-b9bfc44b-0acb-4d23-a022-3ce91e499f99 [19] Rich Collins, Hotel Monteleone Unveils Multimillion Dollar Renovation, Biz New Orleans, (Jun. 29, 2023), https://bizneworleans.com/hotel-monteleone-unveils-multimillion-dollar-renovation/ [20] Orleans Parish Assessor’s Office, 2 POYDRAS ST, (last visited Feb. 26, 2025), https://beacon.schneidercorp.com/Application.aspx?AppID=979&LayerID=19792&PageTypeID=4&PageID=8663&Q=1886938444&KeyValue=2-POYDRASST [21] Id.

By Chris Stow

•

March 4, 2024

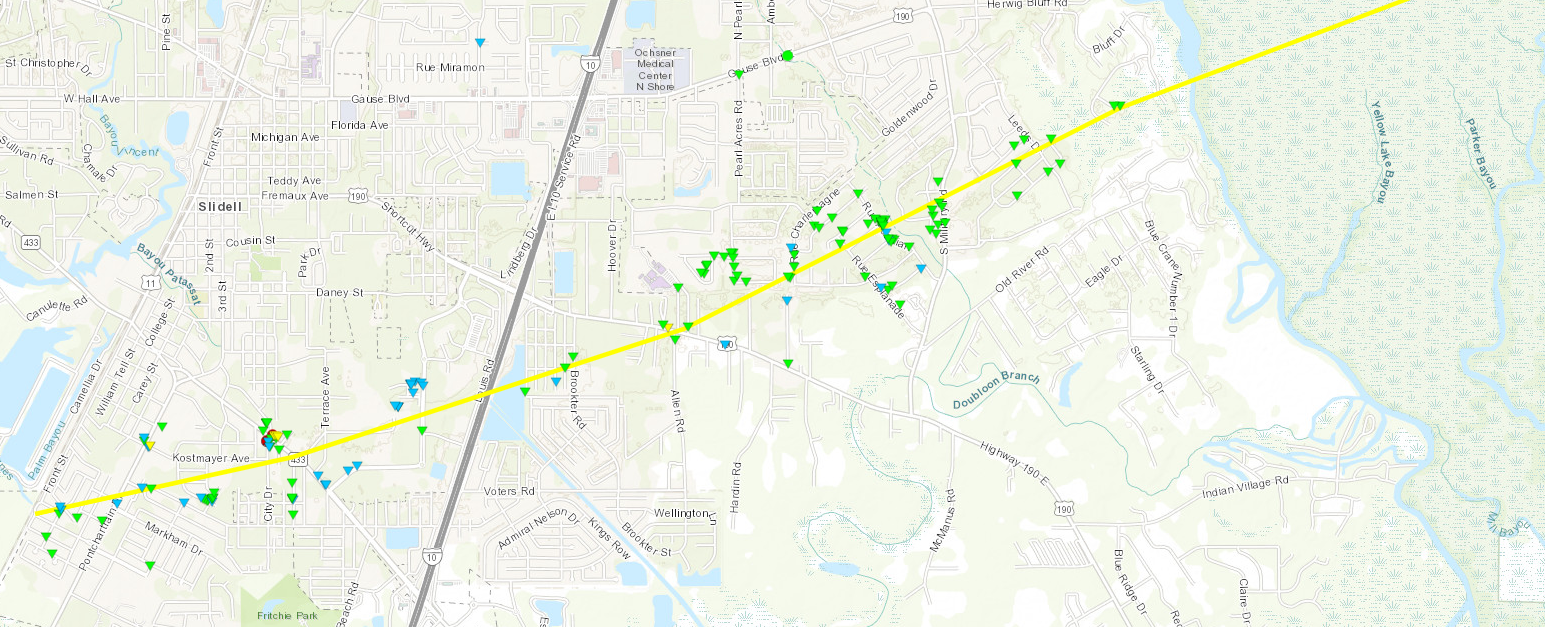

Q: How can I get a short term rental permit in New Orleans? A: Until recently, this was a very complicated question. In 2023, the New Orleans City Council implemented new rules about non-commercial short term rentals (NSTRs). However, shortly thereafter, a federal lawsuit in the Eastern District of Louisiana halted the permit process. Since late summer 2023, a court-ordered stay has been in place, essentially freezing the issuance of all NSTR permits in the city of New Orleans. On Wednesday, February 27, 2024, the stay was lifted when Judge Ivan Lemelle issued his ruling, which largely preserved the permitting rules put in place by the City Council. You can read more about the stay here . Q: Can you tell me more about the ruling? A: The 55 page ruling discusses each element of the new NSTR laws and finds the vast majority to be constitutional. There is a small change that allows trust beneficiaries and usufructories to obtain an NSTR permit. If you believe this may apply to you, please contact our office to discuss your particular situation. There have been a variety of news articles covering and summarizing the opinion, you can read the Times Picayune’s coverage here . Q: So, now that the Judge has ruled, can I actually apply for a NSTR permit? A: Yes. The City has indicated that both the operator (OSTR) and non-commercial permit (NSTR) applications will be reopened. The OSTR permit application is open now. The NSTR application, for new applicants, will open on June 1, 2024. Q: What about the lottery that was held last summer? A: If you were included in the August 14, 2023, lottery it appears that those results are still valid and will be honored. That means that, if you won the lottery for your square block, you will have the opportunity to pay and be issued a permit. Q: What is a square block? A: Check out the example illustration on our blog, here . Q: Can you explain the lottery process? A: Each square block is assigned a five digit lottery ID number and every individual applicant in the lottery is given a reference code and a corresponding bingo ball number. During the lottery, the square block lottery ID number is announced, the reference codes and corresponding ball numbers are displayed, and the balls are tossed in the cage. Balls are selected in order, with a first place, second place, third place and so on and announced. The lottery is only held for square blocks where there are multiple applicants trying to get a NSTR permit. Q: If I won the lottery for my block, or didn’t have any competition for a permit, what happens next? A: The City “will be approving Round 1 applications by March 8th” according to a recent email. In theory, this means that by March 8, 2024, you will receive an email from noreply@nola.gov approving your license and telling you how to pay for your permit. You will only have 5 calendar days from receiving the approval email to pay for your permit. If you believe that you won the lottery for your block, or did not have any competition in your block, but do not receive an email from the City, you should quickly take action to protect your right to a permit. Q: What happens if the first place lottery winner doesn’t pay within 5 days? A: If the City does not receive payment within the 5 day window, the next person in line via the lottery will have the opportunity to claim the permit for that square block. If you receive an email from the City directing you to pay for your NSTR permit, you should pay as soon as possible to avoid losing out on a permit. Q: If I entered the August 2023 lottery and didn’t win, what are my options? A: If you entered but were not awarded a permit during the 2023 lottery, the City send you an email or letter officially stating that your application was denied. This letter will probably come after the first place lottery winner pays their permit fees. The next step will be the special exception process, where an exception is given for you to operate a Short Term Rental on sites like Airbnb, despite your square block already having one short term rental or a property licensed as a bed and breakfast. The Stow Firm is representing clients seeking an NSTR exception to the one per square block rule and can assist you with your exception application. Q: What if I didn’t, or couldn’t, enter last year’s lottery—can I still get a permit? A: Yes and your opportunity is coming up soon. On June 1, 2024, new NSTR applications will be accepted. After you submit your application, one of three things will happen: 1) you will be denied (either because of problems with your application itself or because your property does not follow the requirements), 2) you will granted a permit (if there are no other applicants in your square block and no NSTR permit has been granted for your square block), or 3) you will be entered into the next lottery to compete for a permit for your square block. Q: Once you apply for a NSTR permit on June 1, are you automatically entered into the July 1, 2024, lottery? A: No, you will only be entered into the lottery if the following things are true: your application meets all the requirements; your square block does not currently have a B&B or permitted NSTR on it; and at least one other applicant in your square block also applied during the June 2024 application window and met the application requirements. If you are interested in applying for the upcoming NSTR application cycle, feel free to contact the Stow Firm for assistance in completing your application and learning if there are other already permitted NSTRs or B&Bs in your square block. Q: Does the court ruling impact non-residential, commercial STRs in New Orleans? A: No, the court ruling and application process described above only applies to non-commercial, residential rentals. New commercial STR permits are currently frozen in New Orleans, though you may renew an existing CSTR permit. You can read more about this issue on our blog, here . Q. How much does a citation for an illegal STR listed on Airbnb Cost in New Orleans? Fines for illegal Airbnb listings and other STR violations are $500 a day, with each day counting as a separate violation. See New Orleans Ordinance Sec. 26-629 (a) ("Any person who violates this article or the Comprehensive Zoning Ordinance shall be subject to a fine of not less than $500.00 for each offense. Each day that such violation exists shall constitute a separate and distinct offense. Multiple violations may relate to the same guest stay, day, action, situation, or event, and may be noticed and heard in a single administrative hearing.") As of early March 2024, the City is issuing citations for "illegal" STR listings on Airbnb. Property owners who are issued citations are entitled to notice and the opportunity to be heard at a hearing. Q. Do you offer a service where you will help me with my NSTR permit application? Yes, you can find more information about that service here . This post was updated March 25, 2024.

By Chris Stow

•

October 10, 2023

Are you among the thousands of New Orleans property owners who saw massive property assessment hikes this summer? The average citywide increase in assessed value was an addition of around 23%. But, according to City Council Vice President Moreno, this assessment season there were “more than 60 thousand[] properties with more than a 50 percent increase” in total assessed value. [1] Though the initial assessments and appeal process generated news coverage, little has been heard since and the vast majority of property owners have not learned what comes next. The Stow Firm has been monitoring the Orleans Parish Tax Appeal process and offers this Q and A to help explain what options property owners still have to reach a fair assessment value. Should you wish to discuss your situation or obtain assistance in filing an appeal to the Louisiana Tax Commission, please reach out to us. Q: When I filed an appeal, what am I actually appealing? A: By filing a property assessment appeal, you are challenging the proposed 2024 assessed value of the building, including land and other improvements. Q: By filing an appeal, am I suing the assessor? A: No, this is different than filing a lawsuit, but the assessor is the opposing party in your appeal. As discussed more below, regardless of the Board of Review’s decision either party (either you or the assessor) can appeal to the Louisiana Tax Commission if unhappy with the result. Q: I filed an appeal before the deadline, but I didn’t hear anything about the outcome. Why? A: If you filed an appeal by the August 18, 2023, deadline, the outcome of that appeal has not yet been officially determined. You may have received information about a short, ten minute Board of Review hearing date when your appeal was scheduled for review by a hearing officer. However, even if you attended your hearing date, you would not know the official outcome. Q: Does the hearing officer decide the appeal? A: No. The outcome of your appeal is officially decided by the New Orleans City Council, which acts as the Board of Review. The Council will base its decision on information you submitted with your appeal, information from the assessor, and information from the hearing officer. Q: Has the City Council already decided my appeal? A: No. The Council will make and adopt an official decision about assessments sometime during its upcoming Board of Review meeting. Q: When is the Board of Review City Council meeting? A: It is currently set on the calendar for October 19, 2023, at 9:15AM. You can check the Council calendar for any updates: https://council.nola.gov/meetings/ Q: How will I be notified of the outcome of my property value assessment appeal? A: According to the City Council, “[b]eginning the Week of October 30, 2023, written notice of appeal determinations sent to appellants and the Assessor by certified mail. The Board's appeal determination will also be available at OrleansTaxAppeal.com.” Q: What if I’m unhappy with the results of my appeal—is the decision final? A: If you disagree with the result of the Board of Review’s decision about your appeal, you have the option to appeal, in writing, to the Louisiana Tax Commission. If you do not appeal to the Tax Commission, then the decision of the Board of Review is final and that valuation will be used to determine your property taxes, even if you believe it is incorrect.

By Chris Stow

•

September 9, 2023

How “short” is a short term rental? Short term rentals (STRs) are generally considered to be stays less than 30 days long, though this can vary slightly by locality. In New Orleans, a short term rental is defined, in part, as “the use and enjoyment of a [d]welling [u]nit, or any portion thereof, by guests for a period of less than thirty consecutive days.” This time limit is important because it helps to differentiate short term rentals from more traditional, standard rentals. As all STR owners and operators know, these properties are subject to many, many rules and regulations—including different standards for taxation. STRs usually have to pay a higher rate of taxes than other similar businesses and far more taxes than a traditional rental. What happens if you own a STR and rent it out to someone for 30 days or more? Even though you own a short term rental and may have listed it for rent on a STR website like Airbnb or VRBO, if you are renting to the same person for a stay of 30 consecutive days or more, this is not a short term rental. In New Orleans (and many other places around the country), a 30 day long rental is not taxed at the same rates—or it should not be! Short Term Rental Taxes in New Orleans STR occupancy taxes are usually collected by the booking platform. When someone books a stay, you (as the host) can see exactly how much occupancy tax is being collected and, with a little digging, which taxes are being collected. In New Orleans, for example, Airbnb states that it collects an accommodations tax, general sales and use tax, hotel daily fee, and short term rental tax. Their website provides a bit more information for rentals within New Orleans: New Orleans Sales Tax: 5% of the listing price including any cleaning fee for reservations 59 nights and shorter. New Orleans Hotel Occupancy Privilege Tax: $0.50 per night. STR Occupancy Fee: Nightly fee based on listing type for reservations 29 nights and shorter. STR Equalization Occupancy Tax: 6.75% of the listing price including any cleaning fee for reservations 29 nights and shorter based on listing type. The City of New Orleans, in its outdated STR Handbook, also provides some information about the taxes to be collected (these have been reordered to match the ordering above): City Sales Tax: 5% Occupancy Privilege: (1-299 rooms): $0.50 per night (300+ rooms): $1.00 per night Residential STR Occupancy Fee: $5 per night rented –or— Commercial STR Occupancy Fee: $12 per night rented STR Equalization Occupancy Tax: 6.75% So why are 30 plus day stays still being taxed? Some of these taxes clearly only apply to short term stays, that is, reservations of 29 days or less. However, this doesn’t mean that stays of more than 30 days are charged zero tax. Rather, Airbnb is still charging sales tax for stays up to 60 days long. So, why is Airbnb collecting sales tax for reservations of 30 days or longer? The answer may be in the Louisiana Revised Statutes concerning Sales Tax. These laws explain who owes sales tax when. Generally, hotel guests must pay sales tax on the total of their hotel stay. But, is your STR a “hotel” for the purpose of collecting sales tax from your reservations? In general, the answer is yes. RS 47:301 Sales Tax: Definitions defines hotel as “any establishment or person engaged in the business of furnishing sleeping rooms, cottages, or cabins to transient guests, where such establishment consists of sleeping rooms, cottages, or cabins.” RS 47:301(6)(a). This language is repeated in Orleans Parish Code of Ordinances Sec. 150-441. This clearly includes most if not all STRs. But, what about if you are renting your STR out for 30 days or more? This gets tricky: Under the Louisiana Revised Statutes, “ For purposes of this Chapter, hotel shall not mean or include any establishment or person leasing apartments or single family dwelling on a month-to-month basis.” RS 47:301(6)(a)(iii). Again, Orleans Code of Ordinances Sec. 150-441 repeats this language. However, Orleans Parish Form 8010-STR tax form claims that “Short Term Rental Sales Tax applies only to charges made to transient guests. Whether a guest is transient or permanent must be determined on a case by case basis using the following definitions: Transient guest: one who pays for the room by the day or by the week Permanent guest: one who has a contract and pays for the room by the month and resides in the establishment for at least sixty (60) consecutive calendar days. ” The City provides no support for this definition. What does this all mean for me? This means that even though a booking of more than 30 days does not qualify as a short term rental, the City of New Orleans believes that your guest still has to pay a short term rental sales tax—which is why Airbnb collects taxes in this way. Though remember, sales tax is collected directly from your guest and paid to the City—it isn’t money taken from your payout. Have you been over-taxed? The Stow Firm is currently investigating the legitimacy of this interpretation of the tax laws as well as other discrepancies about how STRs are being taxed. If you believe that you have been over-taxed as a STR host or guest, please contact our office to discuss your case—you probably aren’t alone.